Solar Farms Face Losses from Weather and Curtailment Issues

Two solar farms owned by the Thai energy firm Banpu have reported a combined loss in the first half of 2025, attributing the downturn to adverse weather conditions and operational curtailments.

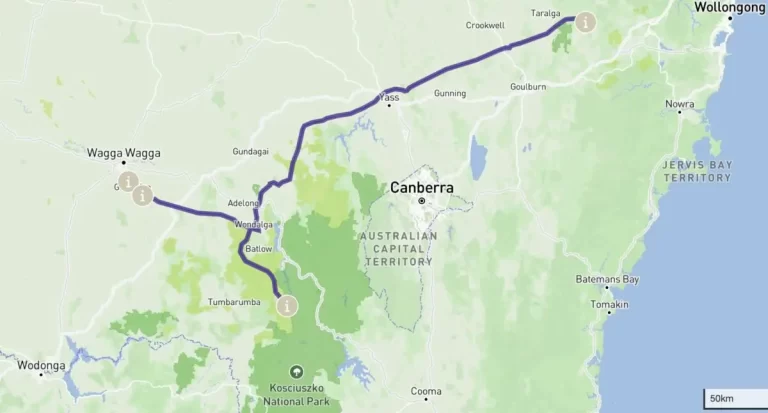

Banpu Energy Australia, which also operates coal mines in the country and has recently ventured into battery storage projects, acquired the Manildra and Beryl solar farms—boasting a total capacity of 167 MW—in June 2021 for $98 million. However, over the past six months, these solar assets have incurred a modest loss of $2.1 million, with $1.4 million recorded in the latest quarter and $0.7 million in the March quarter. This financial outcome occurred despite a $6.2 million gain from derivatives, as highlighted in the company’s recent analyst presentation.

Impact of Weather and Curtailment

Banpu cited “lower power sold due to curtailment and unfavourable weather conditions” as the primary reasons for the significant drop in output, which fell by 10 per cent in the latest quarter and 21 per cent in the first quarter. In the same quarter last year, the company had reported earnings of $5 million from these solar farms, although it faced a loss of $4.5 million in the first quarter of 2024, which was compounded by a derivative loss of $5.7 million.

Industry Trends and Challenges

The disappointing financial results from solar farms are not uncommon, yet detailed disclosures are rare since many owners are either privately held or too large to provide specifics on individual assets. Another publicly listed entity, Acen Renewables from the Philippines, which owns the largest solar farms in New South Wales at New England and Stubbo, has also reported a decline in revenue and earnings from its Australian solar operations in the first half of the year, despite an increase in output due to the expansion of the Stubbo facility.

Solar farms are grappling with the dual challenges of low market prices and curtailment, which often occur simultaneously. Many solar projects are required to or opt to halt production when prices dip below zero, impacting the value of the Large-scale Generation Certificates (LGCs) they generate. This situation has prompted a significant reevaluation of future project developments within the sector.

Shifting Focus to Battery Storage

In response to these challenges, some energy companies are redirecting their efforts towards battery storage solutions. Banpu, for instance, has acquired a 50 per cent stake in the Woreen battery project in Victoria from EnergyAustralia and has recently purchased the Kerang battery project. Other developers are opting for solar-battery hybrids, where solar generation and battery storage are integrated behind the same meter. This setup allows solar energy to be stored and dispatched to the grid when demand and prices are more favourable, as demonstrated by the Cunderdin hybrid project in Western Australia, which is the largest of its kind in the country.

Additional solar hybrids are currently under construction in Fulham, Victoria, and New South Wales, with plans for more facilities, including one adjacent to Banpu’s Kerang battery project that aims to combine a 161 MWDC solar farm with a 55 MW, 2-hour battery system.