NSW Focuses on Solar-Battery Hybrids to Replace Aging Coal Power

New South Wales is banking on solar-battery hybrid projects to supply the essential capacity required to replace its ageing coal-fired power stations. As the state gears up for significant auctions this year, it is exploring enhancements to its long-term electricity service agreements (LTESAs) to better support these emerging technologies.

Solar-battery hybrids are gaining traction due to the falling costs of battery storage and solar energy. These systems blend solar power with battery storage at a single connection point, allowing energy to be saved for peak demand periods in the evening and morning. Recent federal auctions have highlighted their superiority, as they tend to be quicker, simpler, and cheaper to construct compared to large wind farms.

Advantages of Solar-Battery Hybrids

These hybrids also offer strategic advantages in terms of site placement, being more easily integrated with existing network infrastructure. They are generally faced with fewer planning obstacles and experience fewer disruptions in supply chains and transportation logistics.

The proposals form part of broader initiatives by ASL, the consumer trustee managing state and federal capacity auctions, aimed at promoting projects beyond traditional renewable energy zones.

Addressing Capacity Shortfalls

NSW is under increasing pressure to develop adequate capacity as it phases out its coal-fired power stations, which are becoming increasingly unreliable. With closure dates for facilities like Eraring and Vales Point being postponed, there is heightened anticipation that Eraring, Australia’s largest coal generator at 2.88 GW, may continue to operate beyond its expected closure in August 2027, as the state government aims to avert potential shortfalls and price surges during peak evening hours.

Initially, NSW aimed for 12 GW of new capacity by 2030, but has raised this goal to 16 GW to bridge the gap left by retiring coal plants while accommodating the growing demand from both industrial and residential electrification, alongside the rise of electric vehicles.

Upcoming Auctions and Plans

These changes come as NSW is on track to meet its share of the federal government’s Capacity Investment Scheme in the ongoing auction, with results expected by May. The state also intends to restart its own generation auctions in the second quarter of the year, targeting a total of 5 gigawatts of capacity through two auctions this year, with additional auctions scheduled for 2027.

According to Nevenka Codevelle, CEO of ASL, “2026 is pivotal for our efforts in realising the NSW Electricity Infrastructure Roadmap, with generation infrastructure LTESA tenders set to recommence from Q2 alongside our upcoming long-duration storage tender.”

ASL acknowledges that as market conditions and technologies have evolved since the introduction of LTESAs, there has been a significant pivot towards solar-hybrid projects, which generally provide a faster route to market and are crucial for achieving the 2030 infrastructure investment targets.

The Unique Benefits of Solar-Battery Hybrids

Solar-battery hybrids can avoid negative pricing events which typically cause solar farms to shut down during the day. Instead, they store energy for use when it’s more valuable, particularly during periods of high demand.

While only one large-scale solar-battery hybrid—located at Cunderdin in Western Australia—is currently operational, it regularly supplies power during evening peak times and throughout the night. Meanwhile, the first solar hybrid for Australia’s main grid, the Quorn Park facility near Parkes, has recently been energised, and two more projects—Maryvale and Goulburn River—are under construction, having won underwriting tenders in New South Wales in 2023.

Future Prospects and Market Adjustments

Since then, a total of 18 solar-battery hybrids have secured underwriting agreements through two Capacity Investment Scheme auctions, including five in New South Wales—Glanmire, Bendemeer, Middlebrook, Merino, and Tallawang. Numerous other projects are progressing through planning and community consultation stages.

The rise of solar-battery hybrids and the continued reduction in battery storage costs have begun to influence the Australian Energy Market Operator’s planning framework, the Integrated System Plan, which now indicates a much larger share of such hybrids and a reduction of wind capacity in its latest draft report.

In the current CIS tender, which seeks a total of 5 GW of generation capacity, solar-hybrids are anticipated to perform well, with some developers also advocating for wind and battery hybrids. In contrast, Victoria is focusing solely on wind projects for its allocations.

Consultation on Hybrid Generation LTESA

ASL is contemplating how best to customise the LTESA offerings to suit the specific characteristics of solar-hybrid technology. A consultation paper has been released concerning the potential design of a Hybrid Generation LTESA product, tailored to bolster solar-hybrid projects and optimise their revenue potential.

This paper outlines two possible options: one based on a fixed shape and volume model, similar to existing products tied to morning and evening peak demand; and another focusing on generation-following and price risk-sharing, catering to facility exports and imports with a view of them being more dynamic market participants.

For instance, a solar-only profile could achieve a price around $65/MWh, while a shaped solar-hybrid might garner $90/MWh between 9 PM and 6 AM. A generation-following solar-hybrid model could potentially command $100/MWh, along with a 50 per cent price risk share. However, these figures are indicative and will vary based on individual asset management, customer requirements, and overall portfolios.

ASL aims to finalise these options ahead of its next bidding rounds, with 2.5 GW available in the second quarter of 2026 and an additional 2.5 GW tender before the year concludes.

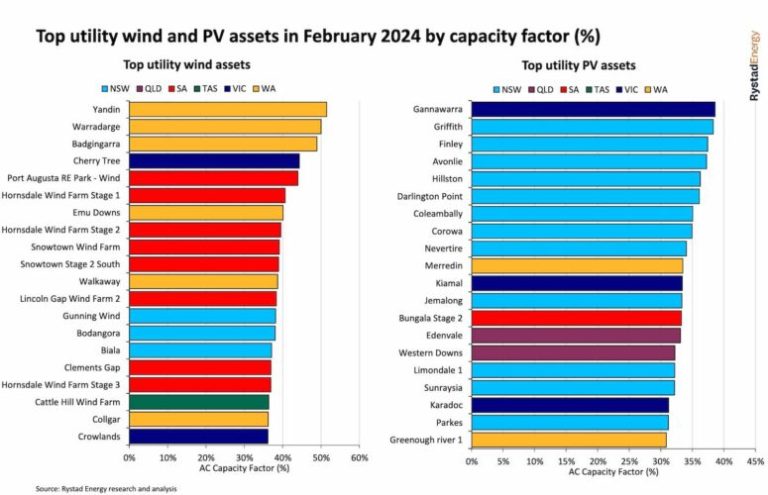

Nonetheless, ASL emphasises that wind remains vital to the energy strategy. “While these new products have been developed to enhance the solar-hybrid landscape, we want to emphasise that wind projects are still a key focus and can equally access this new product, maintaining support through our existing Generation LTESA programme,” Codevelle stated.