ISP warns of delays impacting renewable energy targets and costs

The Australian Energy Market Operator (AEMO) has reiterated that the combination of wind, solar, and battery storage, complemented by a limited amount of gas and new transmission lines, is the most cost-effective path for Australia to achieve its emissions objectives and phase out its aging coal fleet.

However, AEMO cautions that these advantages could be undermined by increased costs stemming from project delays, especially concerning new transmission infrastructure. For the first time, the agency has presented a “constrained” outlook, which predicts that the nation may struggle to reach its 2030 renewable energy goals.

Updated Integrated System Plan Released

The draft version of the 2026 Integrated System Plan (ISP), unveiled on Wednesday, indicates a larger role for coal in the energy mix compared to previous forecasts, largely attributed to the Queensland LNP government’s coal retention strategy. Nevertheless, the plan also notes a significant drop in battery storage prices, which is mitigating rising costs elsewhere.

The ISP acts as a long-term framework, refined every two years by AEMO, and this latest draft has been shaped over 18 months with input from over a thousand stakeholders, generating keen interest from both proponents and critics.

Growth Projections for Renewable Energy

AEMO’s Optimal Development Path (ODP) remains optimistic, projecting an increase in grid-scale wind and solar power from the current 23 gigawatts (GW) to 58 GW by 2030, eventually surpassing 120 GW by 2050. Consumers are expected to contribute significantly, with rooftop solar installations reaching 87 GW by 2050, a rise from the previous estimate of 75 GW. Additionally, 27 GW of small battery storage and 9 GW from electric vehicles will also play a role.

When effectively coordinated via virtual power plants, this collective capacity could reduce the necessity for grid battery storage investments by approximately $7.2 billion. Despite this, AEMO indicates that households are expected to draw only 20 terawatt hours (TWh), even in fully electrified homes, while the overall demand from the grid is predicted to double to over 389 TWh, driven by heightened business and industrial activity.

Cost Challenges and Risks

AEMO estimates that the optimal development path will require around $128 billion in investment, representing an increase of $2.8 billion from the previous year, despite the elimination of some transmission lines deemed unnecessary. While some transmission costs have doubled, the overall expenses are somewhat alleviated by a reduced weighted average cost of capital (WACC) of 3%, a drop from the previous 7%.

Transmission plans have been scaled back by 1,300 km to align around 6,000 km, partly due to the Queensland cancellation of the Pioneer Burdekin pumped hydro initiative. AEMO maintains that the transmission investments will yield a net benefit of $24 billion, including $2 billion in emissions reductions. Yet, it warns that delays in infrastructure delivery, planning obstacles, and supply chain issues could threaten these benefits.

Potential Shortfall in Renewable Goals

In its new constrained delivery scenario, AEMO suggests that Australia might only achieve 75% renewable energy by 2030, falling short of the federal Labor government’s target of 82%, yet still outperforming some overly cautious private sector projections of under 60%. An estimated 35 GW of new grid-scale solar and wind is needed under the ODP, with current projects in progress aimed at delivering the equivalent of 24 GW.

Should the rate of renewable installations slow, coal plants will be compelled to remain operational longer, which raises concerns about grid reliability due to coal’s susceptibility to failures, as emphasised in this week’s Reliability Watch report.

Political and Operational Dynamics

One contributing factor to these challenges is the recent election of a new LNP government in Queensland, which intends to maintain state-owned coal generators in operation until 2049. This decision complicates the development of new wind and solar projects, as their roadmap offers no additional capacity beyond what has already been committed. Coal, which was previously expected to exit the grid by 2040, is now projected to linger until 2049 due to this coal retention strategy, alongside a slight increase in gas capacity.

By 2035, two-thirds of Australia’s coal capacity is set to exit the system, and AEMO asserts that the remaining plants will need to adapt their operations significantly, moving away from the traditional baseload concept towards a focus on dispatchable energy and firming capacity, thereby underscoring the importance of battery storage and gas peaking when necessary.

Impacts of Rooftop Solar and Future Outlook

The substantial influence of rooftop solar is reshaping the energy grid and highlighting the need for flexibility, an area where coal plants have typically struggled. Federal Energy Minister Chris Bowen remarked that the AEMO’s findings reaffirm that Australian households are pivotal in the nation’s energy transition via rooftop solar, battery systems, and electric vehicles, which ultimately contribute to a more affordable power system.

Bowen added that after a decade of ineffective policy, the Albanese Government’s approach for a modern grid, powered by reliable renewable resources with supportive gas and storage, is endorsed by experts. He further noted that Australia is not alone in this transition; globally, renewable energy investments outpaced coal by threefold in 2024, and in early 2025, renewables generated more energy than coal for the first time.

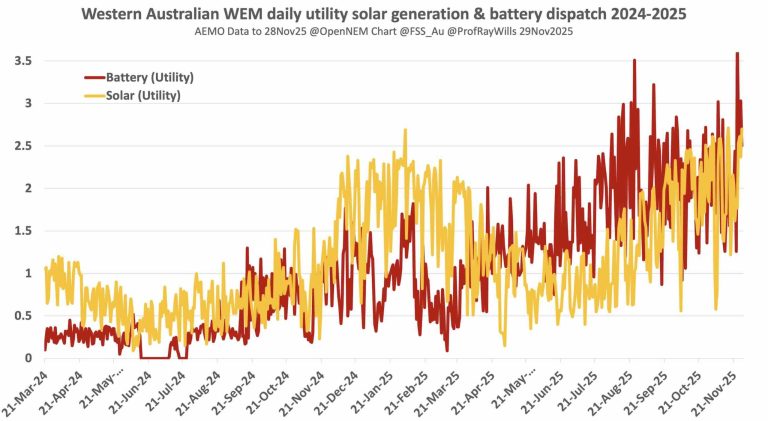

Significant news from the ISP includes a sustained decline in battery storage costs, illustrated by a surge in new connections in the pipeline from 3 GW in September 2022 to an anticipated 26 GW by 2025. These developments include battery or hybrid projects aimed at offering both shallow and medium storage solutions to accommodate daily energy peaks and fluctuations in renewable outputs.

Battery storage technology is also projected to reduce grid security expenses, notably in providing essential services such as “system strength,” transitioning away from traditional synchronous condensers towards the utilisation of innovative grid-forming inverters, which are increasingly incorporated in newer battery projects.

Furthermore, there is growing attention on distribution networks, which have been advocating for recognition of their capacity to support new large-scale projects while managing increased energy flows to and from both households and businesses. The ISP posits that distribution networks could unlock an additional 4 GW of capacity by optimising voltage management and other cost-effective innovations while potentially accommodating further grid-scale generation and storage within their systems.

AEMO’s analysis regarding coal remains a focal point of political discourse and serves as foundational for various criticisms of its projections. The agency notes that coal plants are likely to become more unreliable as they reach the end of their operational lifespans, with full unplanned outages expected to occur 7% of the time from 2027 to 2035, alongside a 17% likelihood of partial outages.

In essence, coal plants may only be fully operational three-quarters of the time during this period, and the timeline for coal retirements could accelerate due to increasing operational costs, reduced fuel security, and rising competition from renewable sources within the wholesale market.