Coal Power Declines as Renewable Energy Surges in Australia

The Australian Energy Market Operator (AEMO) has announced a series of new records for renewable energy generation on the country’s primary grid, but it cautions that further reductions in coal generation are necessary to accommodate more renewables simultaneously.

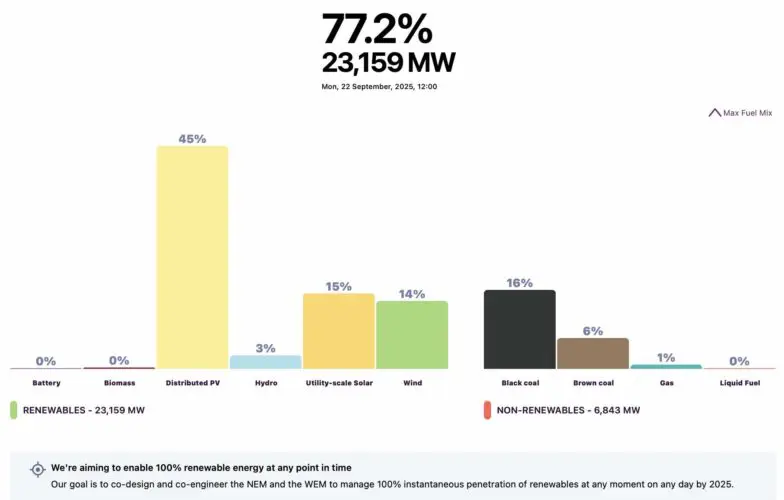

On Tuesday, AEMO reported that the National Electricity Market achieved a new peak for renewable generation, reaching 77.19 per cent at midday on Monday. This surpassed the previous record of 75.79 per cent set just last Friday, also during midday hours.

Understanding the Data Discrepancies

While these figures differ slightly from the 78.7 per cent and 76.8 per cent penetration levels reported by Renew Economy and other data sources, the variance arises from the different time intervals used for measurement. AEMO bases its calculations on 30-minute intervals, whereas other providers focus on 5-minute trading intervals.

The recent surge in renewable energy coincided with a notable decline in coal’s share of the grid, which dropped to 21.9 per cent at 11.55am on Monday, down from the previous low of 22.9 per cent that had persisted since last November, according to GPE NEMLog. Additionally, the combined share of coal and gas reached a new low of 22.5 per cent, down from 23.8 per cent.

Renewable Growth and Future Challenges

AEMO attributes these new records to the ongoing expansion of renewable energy within the system. “These records highlight the scale and pace of change underway as Australia moves towards a net zero energy system,” the organisation stated.

However, AEMO also warned that achieving higher levels of renewable penetration is becoming increasingly difficult. “Further progress will increasingly rely on reducing thermal generation during the middle of the day to unlock more room for renewables,” it noted in a post on LinkedIn.

This point raises an interesting challenge: reducing coal generation necessitates that coal units either adjust their output, temporarily shut down, or close entirely.

Coal Generators Adjusting Output

During the record-setting renewable generation period, three units at Eraring, Australia’s largest coal generator, reduced their output to just 180 MW each at midday, significantly lower than their rated capacity of 720 MW. One unit at Eraring was also offline for repairs.

Similarly, at Mt Piper in New South Wales, both units decreased their output to 150 MW from their rated capacity of 700 MW, down from 450 MW earlier that morning. Bayswater experienced a similar situation, with two units reducing output to 170 MW.

Coal generators are keen to avoid negative pricing, just like their renewable counterparts. However, if they cannot adjust their output further, they must bid low to ensure that their capacity is dispatched by the market operator.

The Impact of Rooftop Solar

The need for flexibility arises because rooftop solar has significantly impacted the coal industry’s midday demand, absorbing much of the energy that would typically be supplied by coal or large-scale wind and solar. Many of these renewable sources are also required to shut down when prices turn negative.

Some coal units lack the flexibility to adjust their output because their owners have not invested in the necessary technology. AGL and EnergyAustralia, the operators of Bayswater and Mt Piper respectively, have indicated they might consider “two-shifting” – shutting down a unit for a shift or a weekend, or even mothballing it seasonally – but there are no immediate plans for such actions.

AEMO’s Ambitious Goals

On AEMO’s NEM data dashboard, the market operator states its ambition to enable 100 per cent renewable energy “at any point in time.”

“Our goal is to co-design and co-engineer the NEM and the WEM to manage 100% instantaneous penetration of renewables at any moment on any day by 2025,” it asserts.

However, achieving this goal within the year seems unlikely. Although there have been instances where the potential production of renewable energy could have met or exceeded overall demand, this has not materialised due to the self-selecting nature of negative prices.

During the record on Monday, over 3.5 gigawatts of large-scale wind and solar generation was curtailed, primarily for economic reasons, according to Open Electricity.

Addressing Storage and System Strength

Increased battery storage could alleviate some of these challenges, but several obstacles remain, particularly those concerning AEMO and major transmission companies.

This issue relates not only to the volume of renewables but also to the market operator’s confidence in maintaining the system services traditionally provided by synchronous generators.

Battery grid-forming inverters have demonstrated the ability to deliver synthetic inertia and have even been contracted by AEMO in certain cases to provide “system strength.” However, transmission companies responsible for maintaining system strength are still opting for synchronous condensers—spinning machines that do not consume fuel—because they remain unconvinced that grid-forming inverters can perform adequately in all scenarios. They are eager to implement these solutions.

Battery storage technology providers, such as Tesla, argue that their systems are both capable and more cost-effective.

AEMO continues to navigate these and other issues in its engineering roadmap, which must be finalised before the goal of 100 per cent renewable energy, even for brief moments, can be realised.